by Abe Sherman – CEO, BIG – Buyers Intelligence Group

November 10, 2020

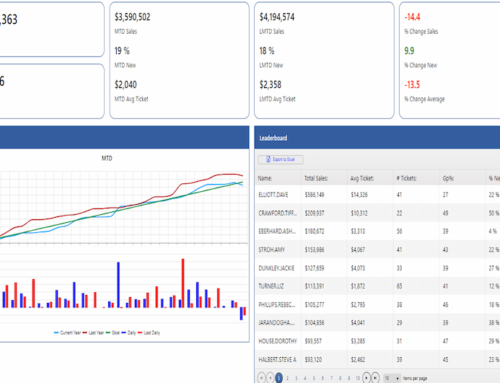

Having recently completed our final Plexus meeting of the season, one thing was true across the board; everyone is in much better financial shape than they were a year ago. Bank and trade debt are substantially lower, cash is considerably higher and inventory, finally, has been meaningfully reduced. These are the results, now let us dig into why.

Fear has been a great motivator this year (The Year of Fear) leading to the overwhelming need to hoard cash. This fear, combined with pumping trillions of dollars directly into businesses through the PPP and EIDL programs propped up balance sheets and not only kept millions of people working, but also significantly reduced the anxiety that most of us were feeling in the spring.

We have also benefited from fear when it came to travel. We are not traveling to tradeshows, and the pressure to buy, buy, buy at these shows was best summed up by one of our clients when we were discussing their company’s Balance Sheet results. He said, “Having me at a tradeshow is like having a fat man at a buffet”. Removing the expectation of having to buy at shows was a two-way street. Not only did the retailers not feel any pressure, but suppliers knew (they knew) that no one was going to be buying much anyway, so they stopped trying to push. The results have come swiftly – inventories are dropping – fast.

You know my mantra has been to do more with less – and more inventory does not always equal more sales. While inventories were dropping, sales were increasing in a big way. Again, we have been the beneficiaries of 2020’s malaise – travel and dining out came to a screeching halt. Cruises, overseas trips, (another trip to Disney), all stopped, as did dining out once or twice a week or buying new outfits to wear during our business meetings or on vacation. The billions of dollars that would have been spent elsewhere stopped being spent – elsewhere. With malls closed, consumers shopped, many for the first time, with their local independent retail jewelry stores. New customer counts have been way up throughout the country. Now that you have them, it’s your job to keep them!

As I wrote some months back in Planning in a Blender, suppliers may be having challenges this fall as their overseas factories have limited production, and we are hearing now that some orders will be delayed or reduced due to production issues. Again, this will result in having less inventory in the pipeline and less inventory will lead to more cash in the bank as well as reduced debt.

Will this improvement in our cash positions last? Will inventories remain lean? What have we learned?

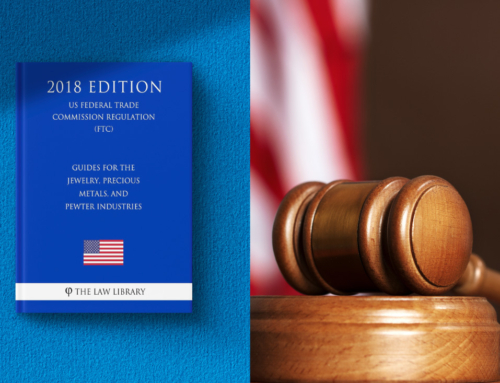

As we were going around the room during our Plexus meetings discussing the substantial improvement in cash, inventory and debt levels, there was one resounding response when I asked each member how they felt about their results – and to a person, they claimed that they will never go back into debt again. They will never allow their inventories to get so high and will be far more diligent about managing their cash. And, this is important, they won’t buy without a strategy.

Strategic buying is about understanding how to merchandise each category and price point, feeding the segments of your business with the highest turns and continue to feed them as sales grow. I am seeing the let’s throw everything at the wall to see what sticks method of buying being replaced by logical merchandising processes and the results have been terrific.

I also believe that suppliers are going to have a very good year in 2021 – since there will be a need for quite a lot of new inventory, and many of them, in turn, have been embracing the same thoughtful strategies to help their retailers succeed. In the years to come, let’s hope that our industry has learned some valuable lessons: Build cash reserves. Reduce debt. Keep inventory lean. Reorder often. Feed those areas with the highest turns – and stay away from the buffet table.