Lab Grown Diamond’s Impact on Profit

by Abe Sherman – CEO, BIG – Buyers Intelligence Group

July 30, 2024

This article appears in the August issue of InStore Magazine. In case you missed it or had a hard time reading the numbers.

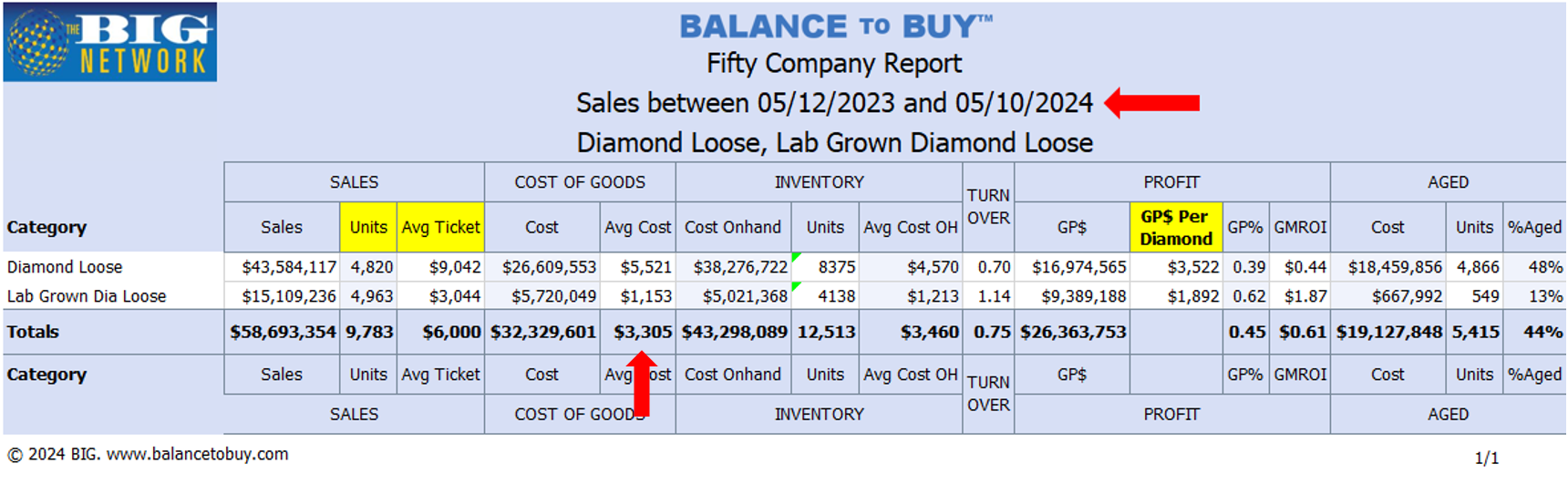

The continued declines in lab grown diamond prices is having a negative impact on Net Profit. LGD’s have taken market share from natural diamonds over the past six years, in many stores exceeding the number of natural diamonds being sold. With the decline in LG prices however, top line sales revenue in the loose diamond category is falling, as is the average selling price and gross profit dollars per transaction. The recent collapse of wholesale prices is accelerating this trend. The first report shows the results on both sales revenue and Gross Profit Dollars when roughly half of loose diamond sales are from LGD’s.

This first report represents only 50 companies (roughly 100 doors) that are members of our Plexus Performance Groups. I’m using this specific data since all categories are normalized for these stores regardless of which POS system they have and what categories they use.

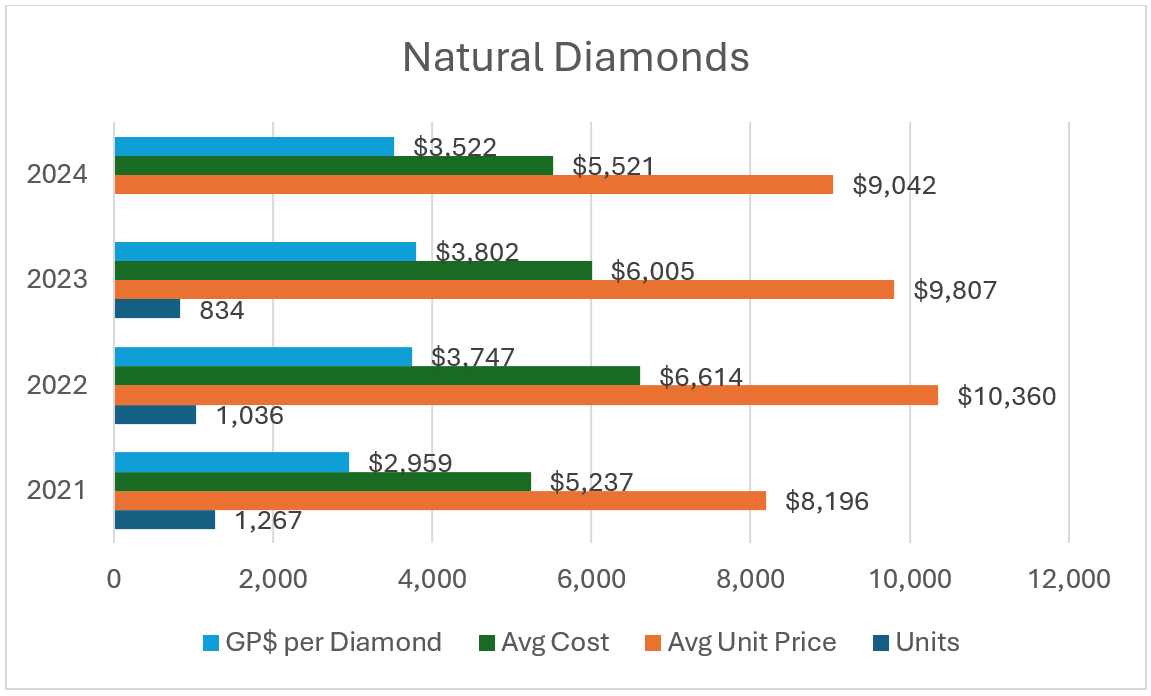

Of the 9,783 loose diamonds sold over the 12-month period ending May 10, 2024, a bit more than half of the units were Lab-Grown. Those 4,963 LGD’s sold for 1/3 the price of natural diamonds. Note the differences in Gross Profit Percentages, 62% for LG and 39% for natural diamonds. While many celebrate the GP achieved from LGD’s, the more important number is Gross Profit $ per diamond sold, which is $3,522 for natural and $1,892 for LG.

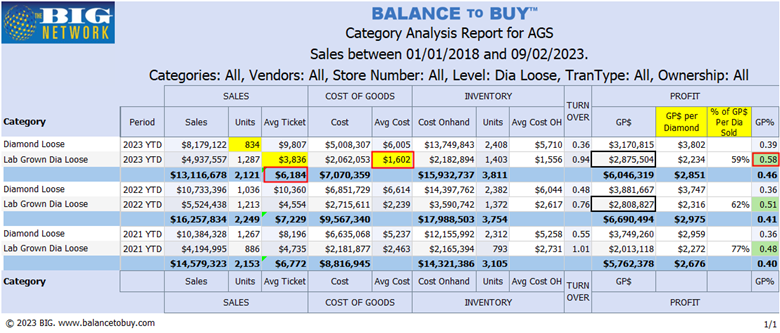

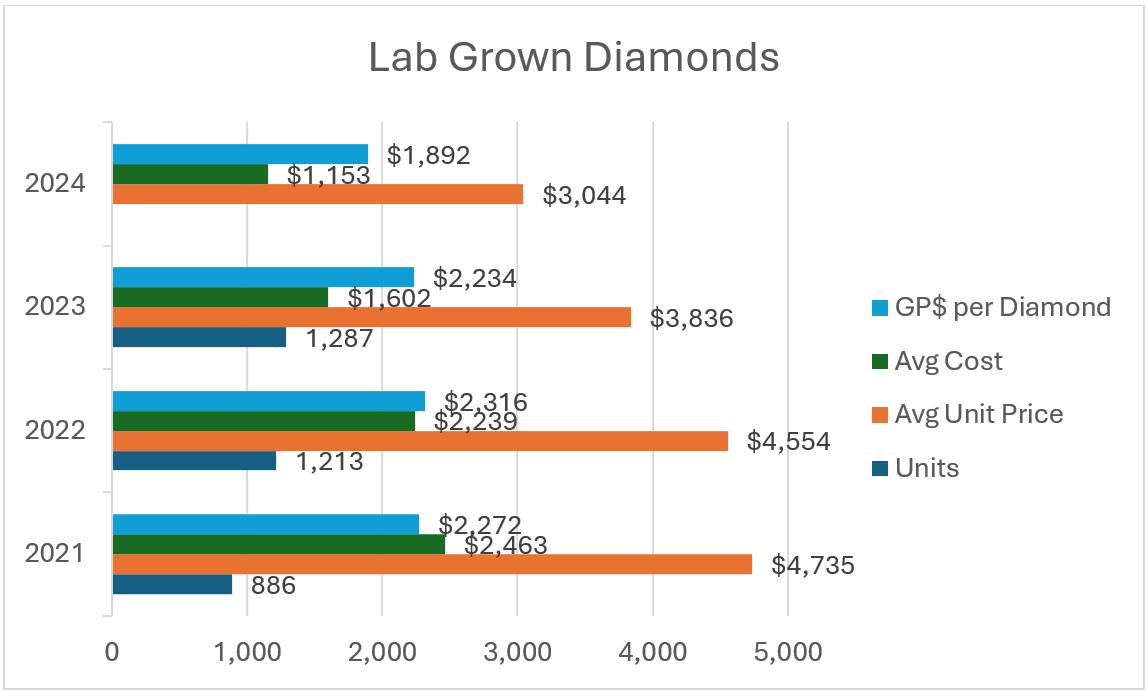

The selling price and unit trends over the past several years are in the next report. This is from a single Plexus group (representing approximately 20 doors) showing results for the first 8 months of each year, trended over a three-year period, but the results are similar across all retailers. Both natural and LGD’s average retail prices are declining as of May 2024 when compared to previous years. The average sale for a LGD in 2021 was $4,735, dropped to $3,836 by August 2023, but as of May 2024, the average sale was $3,044, a 21% drop in one year and a 36% drop per sale since 2021. The average cost was $2,463 in 2021, $1,602 in 2023 but dropped to $1,153 in May 2024 a 53% decline in COGS since 2021.

One of the arguments in support of selling LGD’s over natural is the idea that more people will buy diamonds since they are more affordable. Notice the total number of diamonds sold by category since 2021. The same group of jewelers are selling nearly identical numbers of loose diamonds, but the ratio of natural to LG had flipped.

Retailers who have been paying attention to declines in their average sale and gross profit dollars over the past year have begun switching back to encouraging natural diamonds over lab-grown. The declines in gross profit dollars don’t just impact stores, but staff as well. Sales associates who are compensated based on gross profit dollars would need to double their unit sales to make the same commission.

The Gross Profit Dollars per Natural Diamond sold has declined slightly from 2023 but not nearly to the same extent as LGD’s. It appears that the lower end of the natural diamond market is going to LGD’s leaving higher ticket sales to natural diamonds. Meaning, the more LGD’s that are sold, the lower total sales will be for the overall diamond category, as well as lower gross profit.

The significant reduction in the costs of, and profit from, LGD’s should be considered when making marketing, merchandising and financial plans going forward. The mix of natural vs. LG, markups and gross profit per item sold may need to be adjusted to achieve net profit goals.