Old Habits Die Hard

by Abe Sherman – CEO, BIG – Buyers Intelligence Group

April 16, 2024

I’m sorry to say that too many of us have fallen back into our old habits of buying too much inventory. The results are cash flow is suffering and aged inventory is soaring. These results are predictable because we are coming to the end of a multi-year boon when sales accelerated much faster than inventories were replaced. Virtually all key-performance-indicators improved such as turnover, GMROI as well as aged inventory, which was sold down during the 2020-2022 period. In other words, we lived off of the inventory we had in stock prior to the Pandemic.

While sales are still good (some retailers continue having increases) even though many may be off from the 2021-2023 highs, most everyone’s sales are still far better than they were in the years prior to 2020. If the lesson of the post Covid period was all about growing cash and keeping inventory lean (and turning), it seems that those lessons have been all but forgotten. Cash is declining and inventory, especially aged inventory is back in fashion – just like the olden days of 2019!

We had done it! We watched sales increase far faster than our inventory which resulted in extraordinary results for retailers and suppliers alike. All at the same time, we experienced what an efficient, well-funded, well-managed inventory was supposed to look like. We sold down much of our aged inventory, paid off most of our debt and had plenty of cash in the bank – and everyone was paying their bills on time! But alas…

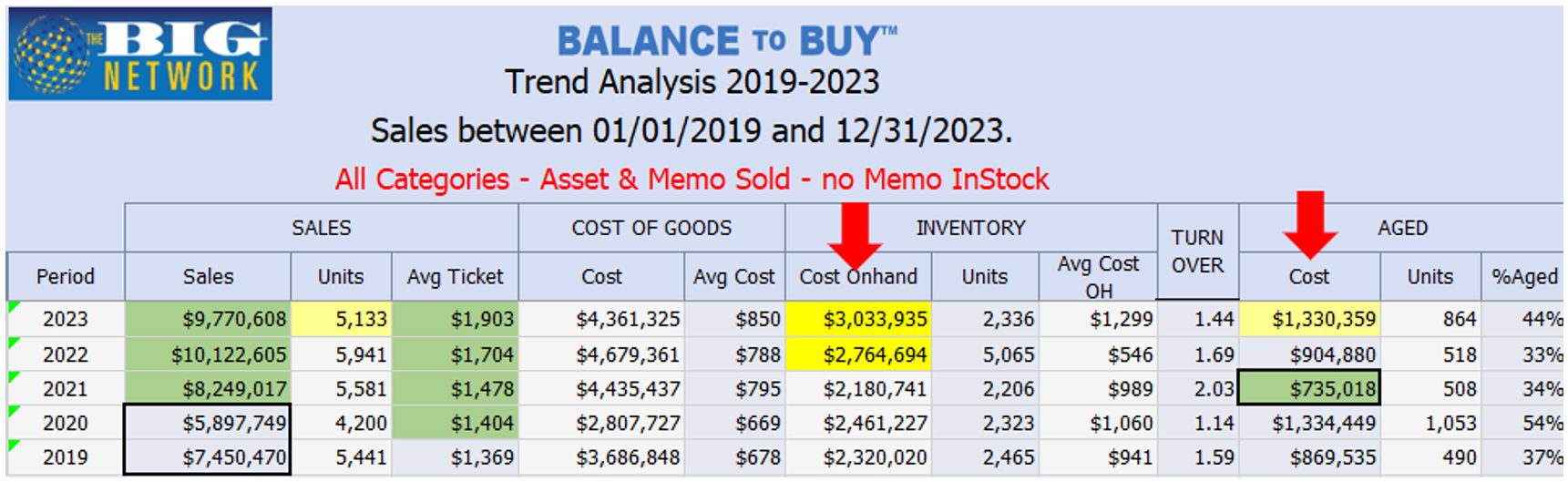

Here is a perfect example of what I’m talking about. Sales peaked in 2022 at $10M. And even though sales declined a bit last year, this store is still far ahead of their 2019 pre-Covid numbers of $7.5M. But two things are also happening. First, Asset inventory (we remove memo goods for this analysis) is up $850,000 from 2021 and you can see how Aged Inventory has nearly doubled from their 2021 lows as well as being back to where it was in 2020.

In 2021, like most companies, this store sold down a good deal of their aged inventory (by $600,000!!) and lowered their year-end inventory by $300K from the previous year. In other words, they lived off of what they owned. I can also tell you that they had significant cash balances at the end of 2021.

By 2023 however, Cost of Goods declined by more than $300K at the same time their inventory increased by more than $300K. Those two things, a rise in inventory levels at the same time they had a drop in COGS typically leads to an increase in aged inventory and of course, a decrease in cash.

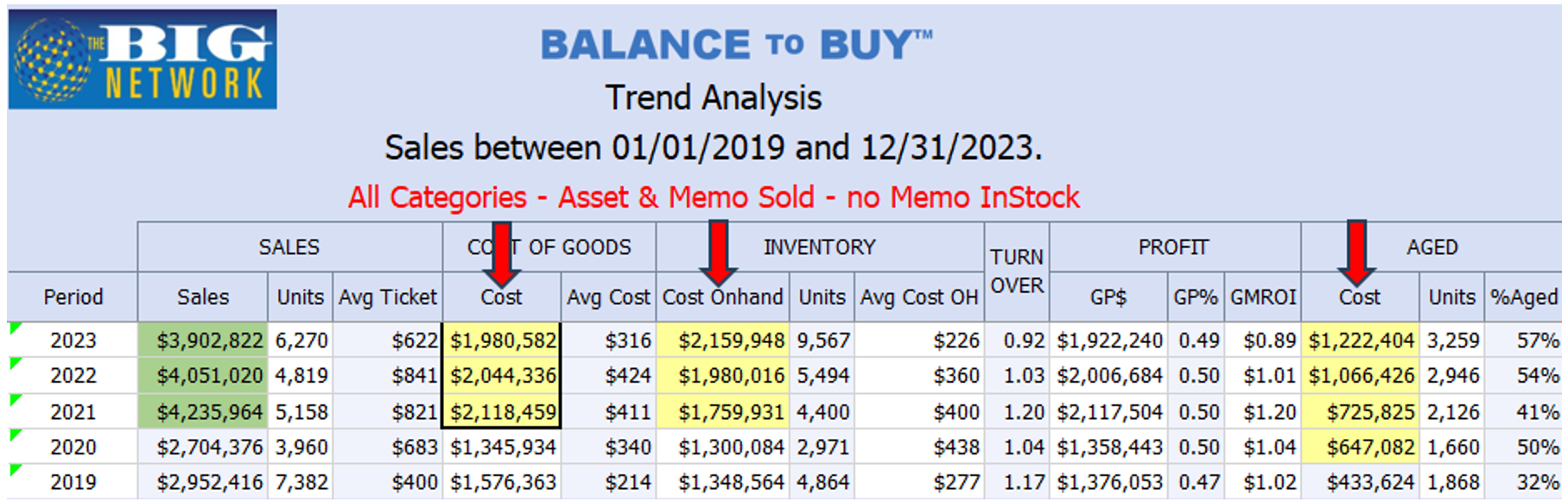

Here is another good example. Sales are off a bit from 2021 but are still $1 Million higher than 2019 numbers. COGS declined by only $138K over the past three years but on-hand inventory increased by $400K and aged inventory increased by $500K from the end of 2021 (not to mention where it was at way back in 2019). Notice that 57% of their owned inventory is over a year old.

Of course, not everyone is falling back into old habits. Many jewelers, having enjoyed the results of lower inventories and strong cash flow, are continuing to maintain a disciplined budgeting process. But for those of you who are experiencing diminishing cash and higher payables and aged inventory, how about we don’t wait until the next crisis to get back to where we were.