To download PDF click here, Synthetic Diamonds_Opportunity or Problem by Abe Sherman

Introduction

I am not opposed to man-made diamonds being grown, marketed or sold, but the debate about manmade diamonds, such as it is, has been about nomenclature, alternative markets and proper disclosure. Proponents (usually growers and sellers of man-made diamonds) make the argument that because they are disclosing the lab-grown diamonds for what they are – they, along with the entire industry, are off the hook. This reminds me of the card dealer at the casino who, upon leaving the table, shows his hands to the cameras, fingers spread wide – indicating he hasn’t palmed any chips.

Synthetic diamonds have been around for many years and have naturally been compared with other synthetic gemstones regarding the minimal effect that those synthetics have had on the value and marketability of their natural counterparts. Why should man-made diamonds be more problematic? Proponents of man-made diamonds have extolled the virtues of being ‘green’ and renewable, without the need to rape the land and money generated from so-called Blood Diamonds will no longer filter to nefarious recipients. Finally, the argument, “You can’t stop progress” is at the forefront of the inevitability argument of man-made diamonds becoming an accepted alternative to natural diamonds – perhaps that’s true.

When asked about grown diamonds, my initial reaction was the marketplace will take care of itself, with man-made being sold alongside natural diamonds, properly disclosed of course; much the same way a cultured pearl or synthetic colored stone is marketed. However, during the JA show in NY (July 2014), I attended a panel discussion on man-made diamonds where Cecilia Gardner of the Jewelers Vigilance Committee addressed the need for retailers and manufactures to take proper precautions to protect themselves from being sued. That was the moment when I changed my position that grown diamonds were merely an alternative to natural diamonds. I had a flashback to my 30 years in retail and what this will mean to our industry, not so much today, but in the future.

Since diamonds represent more than 50% of all sales in our industry, the ramifications of us getting this wrong will have a far greater impact on our industry should there be unintended consequences of manmade diamonds disrupting the industry in unforeseen ways. Will man-made diamonds have little impact on the natural diamond industry, much the same as man-made colored gemstones have had on the natural ruby or emerald market, or will the result be more akin to what has happened to the pearl industry?

Detection

The technology to separate man-made from natural diamonds exists, although the nearly $30,000 price tag puts the equipment out of the reach of most retailers and manufacturers. It is doubtful that the price of detection equipment will become affordable anytime soon, but until man-made diamonds are easily detectable, every retailer and employee in our industry from this day forward will be at risk from being sued.

Nomenclature

Unfortunately, there does not appear to be a battle taking place to get the nomenclature right. In a paper by Frost & Sullivan entitled The Diamond Growing Greenhouses (March, 2014), the authors claim that due to their market research, consumers prefer the term Man-Made to Synthetic and therefore the industry should adopt “man-made” instead of “synthetic”. The paper goes on to explain that the term synthetic is a pejorative in the consumer’s mind and quotes a diamond grower who made the distinction that since man-made diamonds are ‘grown’ the term synthetic should not be used. The fact remains these are man-made, and therefore are not natural diamonds – a strong distinction that these diamonds are indeed lab-grown should be made. However, disclosure and branding alone will not be nearly enough to deal with the potential ramifications man-made diamonds may have on the diamond industry.

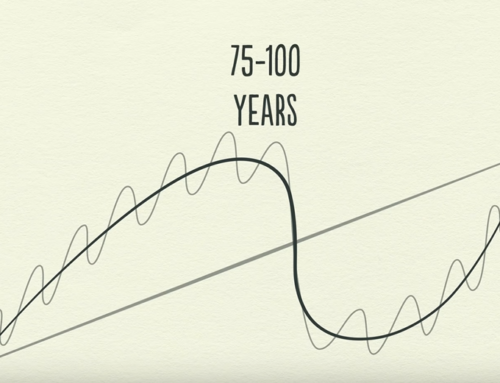

Will History Repeat Itself?

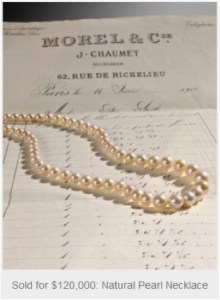

What, if anything, can we learn from the pearl industry? The natural pearl industry has been extinct for decades and only natural pearls purchased at least a century ago are coming up for auction today. By culturing “real” pearls, the cultured pearl industry made the natural pearl industry obsolete and unnecessary. Pearl farming was far easier and more lucrative than dropping people off the sides of boats to search ocean bottoms for oyster bearing pearls; it had taken years to build a single necklace!

A 2013 Skinner Auction sold a strand of natural pearls for $120,000. Will man-made diamonds ultimately replace natural diamonds the same way cultured pearls replaced natural pearls? What none of us alive today remember is how disruptive the cultured pearl industry may have been 100 years ago. Pearls were very rare and very expensive at the turn of the last century. Perhaps the quintessential example of their value is the well known fact that the Cartier building on 5th Avenue was traded for a double strand of natural pearls in 1917. The pearls were valued at $1 Million at that time. But everything soon changed.

Source: Skinner

Mikimoto first cultured pearls in 1905 and opened a jewelry factory in Japan in 1907. Mikimoto’s first overseas store opened in London in 1913 – and I wonder now, one hundred years later, how consumers felt about these “real” pearls and the effect these new pearls had on the natural pearl industry. Cultured pearls were available for more than a decade before the Cartier building was purchased for a one million dollar strand of natural pearls – however the same strand of pearls was sold years later for just $150,000. This begs the question: How will the long-term prices of natural diamonds be affected by those grown in a laboratory? How will the diamond mining industry be affected should the value of natural diamonds drop as man-made diamonds begin to replace them? Is this far too fetched to be taken seriously? Perhaps, but just as Mikimoto wanted to make pearls affordable to the middle class, man-made diamonds may eventually play the same role. The question is, should we even care or is this simply the natural evolution of an industry?

Given that cultured Japanese Akoya pearls replaced natural pearls, only to be replaced themselves a century later by much cheaper non-nucleated fresh water pearls from China, will man-made diamonds become the future of the diamond industry? However, while one only needs a good eye loupe and a penlight to see if a pearl contains a nucleus, and is therefore cultured, detecting man-made diamonds will remain a significant challenge unless a change is made to their manufacturing process. Now is the time to call out the diamond growers, wholesales and our industry leaders to insist that growers add easily detectible fingerprints (a decidedly unnatural florescence, for example) that won’t require every single jewelry store to have the expensive testing equipment to separate natural from man-made diamonds.

How many cultured pearls were sold as ‘real pearls’ during the early days of cultured pearls entering the marketplace? That this happened over and over again I have no doubt, since I have had many, many consumers insisting that their grandmother’s pearls must have been real! And they were real pearls, just not natural pearls.

Disclosure

According to diamond growers and sellers, as long as the synthetic diamond is disclosed as such (well, as man-made anyway), all will be fine in the world. I think we can be confident that most people will disclose the synthetic goods throughout the distribution pipe-line, but the operative word is ‘most people’. Some will not. In fact, some people will try their best to perpetrate fraud by representing the goods as ‘diamond’, much the same way, I’m sure that some people sold cultured pearls as “pearls” 100 years ago. Is it out of the question that ersatz lab reports won’t be created which will “prove” the diamonds in question are, indeed, natural? There is simply too much money at stake to expect otherwise.

We have come to accept cultured pearls as real pearls – today, we only question the claim that the pearls are ‘natural’, otherwise all pearls are understood to be cultured (simulated pearls notwithstanding). But then, as expected, there are cheaters. For example, when did it become permissible for “Akoya” to be used in place of “cultured”? In the examples below, it took me a few minutes of online searches to find one firm selling cultured pearls as Akoya, with no mention of them being cultured.

Source: Pearlparadise.com

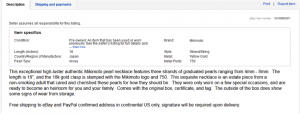

The second example, this time from Ebay, is representing a triple strand as Mikimoto, and even though there was a wonderful description of the necklace, there was no mention of these pearls being cultured, just again, Akoya. This is because over time the need to differentiate natural from cultured has become moot. Will this same thing happen to diamonds in the decades to come?

Source: Ebay

Pure Grown Diamonds

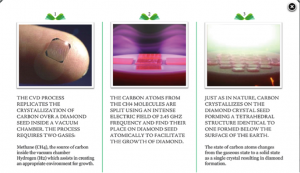

Gemesis Diamonds have branded their man-made diamonds: Pure Grown Diamonds are “certified and sustainable”. The company is very transparent in describing the growing process, beginning with a seed crystal and by using the Carbon Vapor Deposition (CVD) process; the diamonds are grown in much the same way as a natural diamond.

Source: Gemesis.com

However, Gemesis also makes it very clear that they do not wish to be referred to as synthetic.

Source: Gemesis.com

Although the growers, distributers and jewelry manufacturers may be compliant regarding proper disclosure, I have vivid memories of non-disclosed laser drilled and fracture filled diamonds being rampant in our industry, even though we had very strict rules about their disclosure as well. But, what happens in the marketplace in years to come? Anyone can purchase a diamond directly from Gemesis today and while it currently doesn’t make financial sense for a con artist to pass off a man-made as a natural diamond, might that still be the case if/when the prices of the man-made diamonds drops to 50% of their natural counterparts?

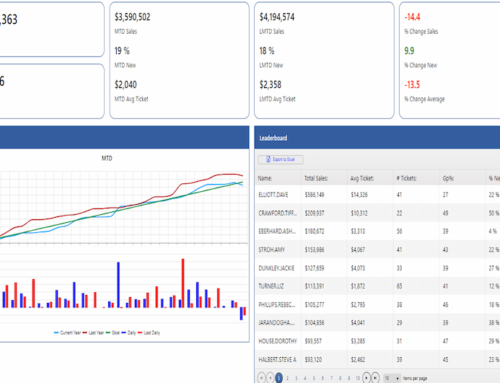

As of today, September 2014, BlueNile.com is selling a 1.01ct G/SI1, GIA for $6,100, while Gemesis has a 1.02 G/SI1, IGI for $4,200. Is this a compelling price difference for most consumers? Maybe or maybe not, but it may just be a matter of time before the spread is, indeed, compelling. What will happen when the price of the natural 1.00 G/SI1 diamond increases to $10,000 but the synthetic drops to $2,500 instead of today’s $4,200? How prepared will our industry be in the coming years when consumers are able to buy man-made diamonds online and then bring them into their stores for some servicing. Honest people may get hoodwinked as this will be a con artists dream. Those lawsuits against retailers will be compelling… and extremely profitable for attorney and client alike. However, it will be a nightmare for the industry.

We need to look no further than the debacle of the diamond grading nomenclature to see firsthand, over and over, diamonds which are misrepresented for both clarity and color by “legitimate” grading labs, claiming, simply, the grade is a matter of their opinion. Our industry has done a poor job in preventing the misuse of a recognized diamond grading nomenclature, but in this case, at least we are assured that the erroneous grade is going to be erroneous because of the paperwork that accompanies the diamond! We know, for example, that the same diamond graded by four different labs will very likely have four completely different clarity and color grades, cloaked as opinions.

Furthermore, we can almost be assured which labs will provide consistent grading the farthest from GIA or AGS opinions. Providing printed documentation or even laser inscribing the girdle simply won’t be a strong enough differentiator for man-made diamonds entering the marketplace through various means. In the future, those documents will get lost (or tossed) laser inscriptions will be polished out and the ‘diamond’ will have been easily laundered as natural, leaving the front line retail jewelers and their staff exposed. Proper disclosure in 2014 will be a serious liability in 2024. Every single diamond entering a jewelry store will have to be treated as suspect – what will that do for consumer confidence?

Speaking of Confidence

There are two areas of confidence I’d like to address: consumer and banking. Consumers, already confused and suspicious of an industry which can’t agree on a grading nomenclature that even remotely resembles a standard, will be (rightfully) outraged when confronted with the issue of their diamond’s authenticity being questioned. Every man-made diamond being sold today will have to be serviced; reset, resized, re-tipped or re-appraised at some point in the future and at that time, perhaps years from now, the decisions made today will either prove to protect the consumer and the retailer alike or, if no action is taken today, have the potential to cripple the diamond business of the future.

Diamonds are worth what they are worth because people are willing to pay their price: Period. If consumers lose faith in the authenticity of their diamond they may just forget about buying natural diamonds altogether; given the potential financial risk, what would be the point!

The second issue I see that may haunt our industry is the confidence the banks have in lending on diamond inventories. Bankers are not going to lend billions to the diamond industry if they have questions in their minds that the goods in the vaults may or may not be natural diamonds. How hard will it be to exchange synthetic diamonds for the natural in the boxes and stone papers? Why would a diamond company do that? (Greed? Financial stress?) The reasons won’t matter, but as the cost of natural diamonds increase and the cost of producing man-made drops over time, the difference in values will continue to widen and the pressure to cheat will increase.

Next year (2015) marks the 60th anniversary of the first GIA Diamond Grading Report. Imagine being in the room with Robert Shipley, Richard Liddicoat and Robert Crowningshield, as they were discussing whether or not to protect the GIA diamond grading nomenclature. Someone must have stated adamantly (not to mention ironically), “What’s to protect? A “G” color is a “G” color!”

We are living with the consequences of the decision to not protect the diamond grading nomenclature with gross misrepresentation (pardon me, gross differences of opinions) being rampant. If these three gentlemen had any insights into what a debacle the bastardization of the GIA nomenclature would look like today, perhaps they would have considered a different course of action 60 years ago. In that regard, what decisions are we making today that decades from now will be looked upon as being naïve or even foolish? The barn door is wide open and our industry needs to shut it, in my opinion.

Long Term Value Differences

Diamonds have increased in value consistently over time. This may have been due to monopolistic price controls in the past, but these days global demand and exchange rates have done more for the increases than one company’s mere goal to continue to raise the price of goods. Diamonds have been known for centuries to be a store of value – an investment, or at least a hedge against inflation. Wealthy individuals have considering starting funds to invest vast pools of money to purchase large diamonds.

Alternatively, typically the value of man-made products over time tends to decrease. As more producers enter the market, technology improves, efficiencies and manufacturing methods evolve the prices of man-made materials will tend to come down, unless raw materials costs increase dramatically. In 2014, a man-made diamond would cost a consumer approximately 30% less than a natural diamond. However, as the prices of natural diamonds increase, and at the same time, man-made diamond prices decrease or even if they remain at today’s values, the spread between the two may cause problems in several areas.

Unintended Consequences

Will future generations forego natural diamonds altogether, opting instead for the much cheaper alternative? Will this spread in values encourage more fraud? Will the underlying threat of this fraud undermine the confidence in purchasing natural diamonds and therefore also undermine their value? And then, will diamond wholesales who are tight on cash sell off their natural diamonds and keep manmade diamonds in their places to show their bankers that all of their millions are safe and secure? Will banks lose confidence in our industry altogether and stop funding us?

Who is Responsible?

I participated on a panel discussion at JCK Las Vegas (June 2014) where another panelist, a wellrespected diamond cutter, was openly extolling the virtues of selling man-made diamonds. At the panel discussion at JA in NY I attended when Cecilia Gardner spoke of jewelers needing to protect themselves from being sued, was another panelist who was a distributer of man-made diamonds. When I pointed out that current disclosure practices and laser inscriptions alone were not adequate to protect future generations of consumers and jewelers from being hoodwinked, and that additional, easily detectable markers need to be introduced during the growing process, her answer was, “We don’t grow diamonds, we just sell them”… In other words, that’s not her responsibility.

So, here’s the question, who is responsible for mitigating this potential threat? Does this responsibility fall to the sellers of man-made diamonds, or to the growers? And finally, who in our industry is taking on the responsibility of protecting us from ourselves? We’ve heard too many times “It’s not our job to be the policemen of the industry”. Let’s just wait around until the FTC decides we need to clean up our act – we’ve not done a great job doing it ourselves.

The growers may think they have zero incentive to introduce materials into the growth process to make man-made diamonds easily detectible. However, I would make the case that growers of man-made diamonds should be extremely anxious to insure that the health of the diamond industry and the continuation of the long-time trend of increasing natural diamond prices. Were the unintended consequences of man-made diamonds to cause a collapse of natural diamond prices (much like the dramatic drop in natural pearl prices decades ago), man-made diamonds will be worth substantially less. Where would the incentive be to buy a man-made diamond if the natural prices keep dropping?

Just as we have seen in the pearl industry the marketplace will always look for cheaper alternatives. The cultured pearl industry replaced the natural pearl industry and while pearls became unremarkable in their rarity, they simultaneously became a wardrobe staple, expanding the pearl market overall. But over the past 20 years or so, much cheaper, non-nucleated Chinese freshwater pearls have largely replaced their far more expensive Akoya cousins.

A cynic’s view

One could argue that all industry organizations have incentives to get the genie back in the bottle. Don’t DeBeers, GIA, JA, and AGS each have a dog in this fight? If I was being cynical, I would say that questioning a diamond’s authenticity would fit perfectly into the Forevermark brand being certified as genuine natural diamonds – along with their accompanying “mine-to-market” documentation and proprietary holographic imagery. GIA lab reports may be ever-more important components in the sale of a diamond, that is, unless 30 years from now, one will be able to buy a fine one-carat “diamond” for $995 as the price of the man-made diamonds will likely drop over time. What about the membershipdriven industry organizations, such as JA and AGS, who each have enormous incentives to keep their membership healthy. Where is their voice in this discussion? Or, as with the diamond grading argument, will the same old refrain be; “We are not the policemen of the jewelry industry”.

Rough Supplies and Diamond Cutters

If the “diamonds-are-rare-and-getting-rarer” crowd is correct, there will be shortages of rough (natural) diamonds in the years to come. Man-made diamonds will be able to fill in those shortages with a readily available and sustainable supply. Diamond cutting is a global industry, employing over 1 million cutters in India alone and those cutters get paid by the stone or the carat. It won’t matter much to them what they are cutting, as long as they are getting paid. If I asked a diamond cutter (we used to call them “diamond manufacturers” but that would be way too confusing today) why they were cutting manmade diamonds, would they explain that finding affordable rough was a constant battle. In fact, when the price of rough increases ahead of the finished good’s selling prices, cutters will often lose money on the finished goods, unless they have the wherewithal to hold onto the goods until they get their price – which few can do.

A sustainable supply of reasonably priced rough, albeit grown in a laboratory, would, at least for cutters and manufacturers, offer an alternative to difficult-to-get and ever-more expensive natural diamonds. The irony in the battle between natural and man-made will be the rarer and more expensive mined diamonds become, the more need there will be for the man-made diamonds. Will, then, DeBeers and other producers opt to lower the price of rough diamonds and put more goods onto the market in order to keep pressure on the growers? Will a price battle ensue? If the miners are able to sell for less, will the growers be able to lower their prices by the same percentages? But if miners continue to increase the price of rough and global demand continues to outstrip supply, will this kick the door wide open for growers to take more market share, especially should the price of man-made diamonds fall over time?

Millennials Going Green

In addition to the supply side we have to consider the consumer – what will they want? Who might be the target audience for “man-made” diamonds? At least in the USA, Millennials have demonstrated some predilection towards sustainable and renewable products – they recycle. Will man-made diamonds be an attractive alternative to mined diamonds for an entire generation? And what about the generations who come after the Millennials? When another billion people populate the planet and natural resources continue to disappear will strip mining become more detested than it is today? Will buying a mined diamond have the same reaction to future generations as buying elephant ivory does today?

Irony

Ironically, the lawsuits are finally heating up regarding blatant misrepresentation of diamond grading, and in my opinion these suits have been long overdue. It’s outrageous that our industry won’t police itself and that we have allowed so-called ‘labs’ to bastardize our most recognized and accepted diamond grading system. History shows us that there isn’t a single jewelry organization with the will or the teeth to take on the most fundamental issues such as the proper representation of a diamond’s grade. While it’s true that there is no legal standard for grading diamonds and the difference in a single color or clarity grade may be a matter of opinion, the utter fraud that we have come to accept in grading will be child’s play compared with the potential fraud that may be thrust upon our industry with man-made diamonds. After all, which industry organization is going to address this issue? Man-made diamonds are a Pandora’s Box that may very well undermine our entire industry and we need to get ahead of it. This is a rare watershed moment for our industry where we are still near the beginning days of this issue. Shame on us all if we just let it play out, much the way the diamond grading debacle has played out, to the detriment of our industry.

Conclusion

Alchemists have been attempting to replicate the earth’s elements for millennia, but why? Is it simply to make it cheaper, to insure a steady supply of rare materials or because there is a lot of money to be made by selling copies? Regardless of the product being replicated, or whether they are synthetic, labgrown, man-made, cultured, simulated or simply knock-offs, the business of duplicating natural materials or well-known brands will only accelerate in years to come. Ersatz products represent, reportedly, more than $1 Trillion in global revenue already and the fact that diamonds are now firmly on the playing field makes me a little nervous.

I don’t want to be an alarmist, but we really don’t know which way this is going to fall. Will man-made diamonds have little effect (like the synthetic corundum version of “Alexandrite” popular in tens of thousands of birthstone rings, which has had zero effect on the prices of natural alexandrite), or will it be more akin to what happened to the values of natural pearls, years after cultured pearls were introduced. Will the introduction of easily detectible attributes to the growth process be enough to protect the retail side of the industry or will our future be based on having malpractice insurance against the onslaught of impending lawsuits since most employees in jewelry stores will not have the proper training or equipment to avoid the risk. There is much work to be done in this area, shame on us if we do nothing.

© 2014 Abe Sherman Buyers Intelligence Group