I spent the weekend thinking about how retail is going to be disrupted in the coming weeks, and in some cases, perhaps months. But the doors will open and, as I wrote before, your inventory will still be intact. While this temporary closure has been a pain for retailers, what impact will this shut-down have on your suppliers?

- COVID-19 hit the pause button on businesses and the inventory that should have sold in March, April (and May???) will still be in your showcases.

- Reorders will have stopped with many retailers still needing to pay off their purchases from last year!

- Payments will be delayed but they will get made, eventually.

Let’s consider that our industry is not merely made up of thousands of retail stores, but also thousands of suppliers, who, in turn are dealing with their own suppliers. I’m not writing this so you can feel sorry for them but writing about how we can help each other through this challenge and create partnerships with our suppliers that will long outlast the short-term effects of the shut-down.

Retailer’s three short term problems: cash flow, time and inventory.

1. Cash Flow

The average jeweler has more than enough inventory – in dollars – in their showcases. The job now is to convert that inventory to cash and using that cash to reduce debt, especially trade debt.

2. Time

In a normal year, paying bills is a relatively slow multi-month process, yet is somewhat predictable. This year, however, you can throw your cash flow predictions out the window since we don’t know what the next 6-12 months will look like in your store.

3. Inventory

Your inventory will sell down and your payables will get paid, over time. Our hope is that when you do get your inventory and payables down, you actually like it! This is a good time to have an end-of-year goal for your inventory. How much do you want to sell down and end up with on 12/31/2020?

The mission is to help fix our industry’s long-term fundamental cash flow problem; lower inventory = better cash flow.

Supplier’s issues to consider: Financing, tradeshows and the role of the sales representative.

1. Financing

Banks have not financed supplier’s inventories for some time, but they will finance their receivables. The supplier may be able to get 70 cents on every dollar they invoice to build inventories, pay staff and keep their companies running. However, if a receivable goes beyond 90 days, the bank will typically decrease that amount from the supplier’s available credit line. Needless to say, this year, virtually every one of your suppliers is going to be struggling with aging receivables and a severely diminished cash flow.

2. Tradeshows

For many tradeshows, the season has come and gone with some shows moving to the fall but others yet to announce new dates. We have been attending JCK for the past 20 years and even if they move their shows to later this year, how many retailers will have the appetite to attend, let alone buy inventory?

3. Sales Reps

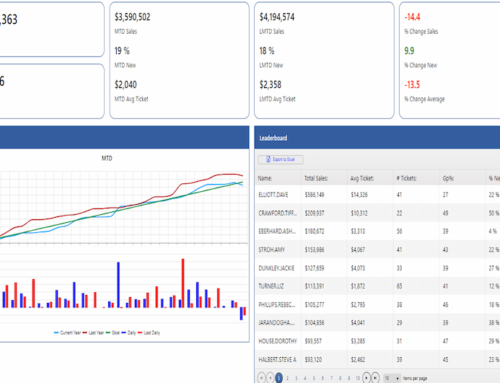

This is the area where I am very hopeful to see dramatic changes in retailer-supplier relationships. Vendors and sales reps are always taken aback when we tell them how many suppliers the average retailer buys from in a given year (too many). At BIG, we believe the future of the industry will lie in working smarter with fewer retailers working with fewer suppliers. That means in order to help you develop the right merchandise plans vis-à-vis their own product offerings, sales reps will have to know how to solve before they can sell. In order to do that, they will have to get to know your business better, your market better and your customer base better. This will require data-sharing, analysis and a different mindset, and even perhaps a different kind of sales team, one that is trained, not only on product, but also in inventory planning and management.

Suppliers who understand this are using data to drive their own decisions by training their sales team to analyze how each of their clients align with their company. Hey retailers, you do the same thing in your stores every day! When you have a relationship with a customer, know their family, where they went on vacation (or not), know the names of the family pets and what jewelry they have on their wish list, the relationship is naturally stronger. This is how the supplier/retailer partnership might evolve. As you think about your suppliers this year, please consider how best to work together through data-sharing, collaborative merchandising and a mutually beneficial financial arrangement.

So, how do we create a lasting partnership between retail jewelers and their suppliers?

First off all, whenever you can, start sending your suppliers payments every week or two. They need the cash flow more today than ever. Second, please don’t expect most of them to be up for stock-balancing this year – some may be able to, but they will be the exceptions. Look at it this way, you bought it, so let’s get creative about selling it. If your supplier closes their doors, you’re going to have to deal with it on your own anyway, so let’s just skip the painful arguments and make a plan on attacking that inventory in-house.

Unless you are opening a new location and need to merchandise an entire store, new inventory purchases should become considerably smaller, but more frequent. Everyone wins with smaller purchases made consistently throughout the year. Being lean also means being nimble and when you’re nimble you can respond and pivot much faster than when you are bloated with inventory and payables. The pressure many retailers have to sell down inventory to pay taxes or invoices would be diminished, which has a positive impact on margins and cash flow.

What impact will this shut-down have on your suppliers in the short run and our industry in the long run? This is the question that I’ve been trying to noodle through. You see, if we do this right, when we get through this year, there may be a desire (or a need) to change the way we manage this entire system. Long terms don’t help you in the long run – leaner, faster-turning inventories do. Will this pause be the catalyst for improving our industry’s average turnover from less than 1 time to something that makes more sense? Let’s get to work on that: Together.