You Reap What You Grow

by Abe Sherman – CEO, BIG – Buyers Intelligence Group

February 28, 2023

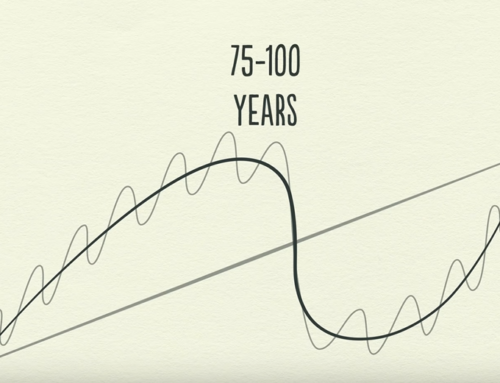

It is stunning, albeit not at all surprising, to have witnessed the extraordinary rise and collapse of manufactured diamond prices in what should be measured in months, not years. Roughly 60 months ago the hype was about buying a ‘lab-grown diamond’ for 30% less than a ‘mined diamond’. Then it was 50% less. But today lab-grown diamonds are being offered at -94, -95 or even -97 back of Rap.*

And there we have it. The demand that had outstripped supply has reversed, and as the supply caught up and too many people jumped into the growing, cutting, and selling of synthetic diamonds, those who got in too late realized the value of their inventory was decreasing every day. Jewelry suppliers and retailers who purchased their goods were upside down, so they’ve started dumping goods. Or, perhaps, is it something else?

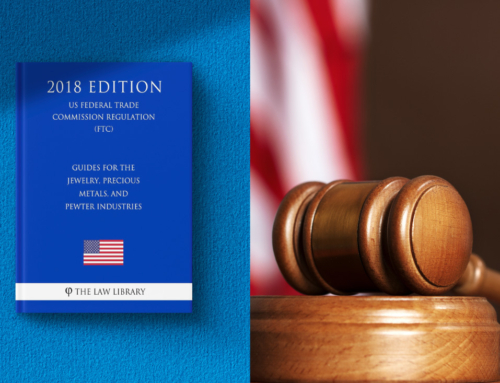

The fact that this market was created by providing grown-diamond goods almost exclusively to retailers on memo should have been the first tipoff that few were willing to invest in synthetic diamonds. Those growers who got in early made fortunes off of an industry that was quick to embrace the next Tulip Bulb craze†. Unfortunately for the industry, manufactured diamonds were accepted as an equivalent to natural diamonds, with far too many retailers and diamond and jewelry wholesalers embracing the rhetoric of the synthetic diamond folks: Earth Mined diamonds are bad, lab-grown diamonds are good. Lab-grown diamonds were not synthetic, were bigger, better, and cheaper than mined diamonds. It was a compelling narrative that many in the industry embraced. Unfortunately, retailers and diamond and jewelry manufacturers convinced themselves and their consumers that it was all true.

Prices per carat are being tossed around to manufacture CVD diamonds ranges from $150/ct to $250/ct. Of course, the quality or size doesn’t seem to matter much since there is nothing rare about any of it.

But now what?

This horse isn’t going back in the barn, so we are left with an ultra-low-cost mass-produced product that has been represented as being the same of the genuine article, but at what is now a small fraction of natural diamond’s prices. Will there be two distinct markets, natural & manufactured? Or will the so-called benefits and nature of manufactured diamonds continue to be hyped to an unsuspecting industry and consumer?

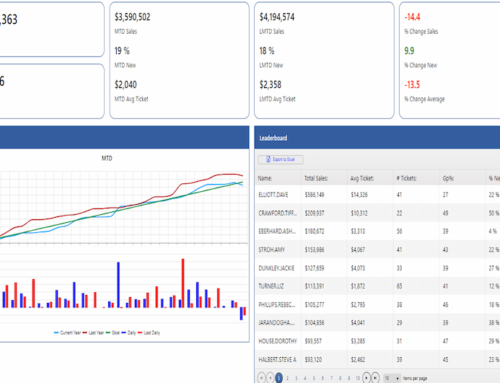

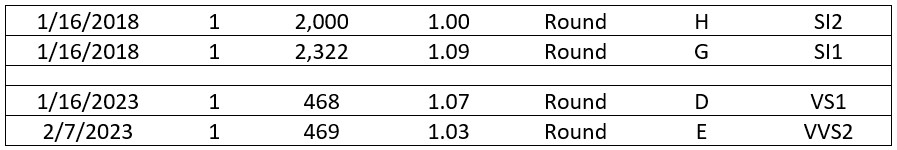

We have years of data on LG diamond prices. Below is an example from a list of nearly 100,000 lab-grown diamonds that have been bought, primarily on memo, showing how far their prices have declined in the past five years. What were considered “better” manufactured diamonds 5 years ago, the 1ct G/H SI quality range, cost about $2,000 or so per carat. But the most recent prices of a better quality 1ct D/E VS-VVS LG demonstrates what has been roughly an 80% drop in their cost in just 60 months. The costs listed below are for the stone, not per carat.

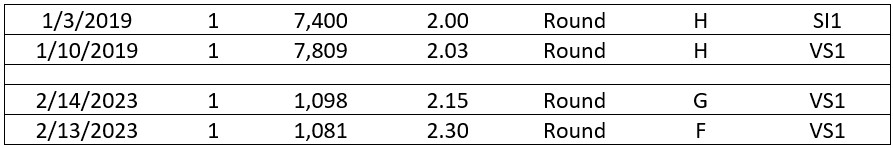

The price drop is far more dramatic in larger sizes. The synthetic version of what used to be a good diamond sale, a 2ct G VS, now costs about as much as a decent-weight gold bracelet. Whereas a few years ago, a 2ct LG cost $3,500-$3,900 p/ct, today their prices are hovering around $500 p/ct, nearly the same as the 1ct sizes, demonstrating the true linear pricing structure of manufactured diamonds.

Tying manufactured (synthetic) diamond’s prices in any way to natural diamonds was a farce. The cost to produce these goods has not magically come down by 80%. The electricity required to generate the reactors hasn’t come down 80%, the labor hasn’t fallen 80%, the facilities aren’t 80% cheaper to build. No, the only difference in what these goods are being sold for today is simply the amount of competition in the market. Keep in mind, there is little barrier to entry and the profits that the growers were generating have been enormous. Given what they were charging, I imagine their markup would make a pharmaceutical company envious. By plowing those profits into more and more capacity, I believe we are just at the beginning of seeing what these goods are really worth – a few hundred per carat.

Lest we forget, Lightbox began by selling their lab-grown diamonds at $400/ct regardless of size. Maybe they know a thing or two about their true value after all.

So, where are we now? When the $6,000 1ct natural diamond could be replaced by a $4,000 lab-grown diamond, with great margins, there may have been a compelling reason to sell them. But with today’s cost of less than $500, jewelers are going to be selling them for far less than their customers were otherwise willing to spend on their “forever ring”, their “gift of love”. What do you do now, UNSELL the same message that lab-grown diamonds are better than earth-mined?

How do retailers make up for the loss in gross margin dollars selling goods that cost a few hundred per carat? Now, the man-made diamond industry wants to de-couple from Rap pricing. One thing is for sure – selling manufactured diamonds at 98% back of Rap shows the absurdity of comparing their values to natural diamonds. But it has always been absurd. You all have some decisions to make.