By Abe Sherman

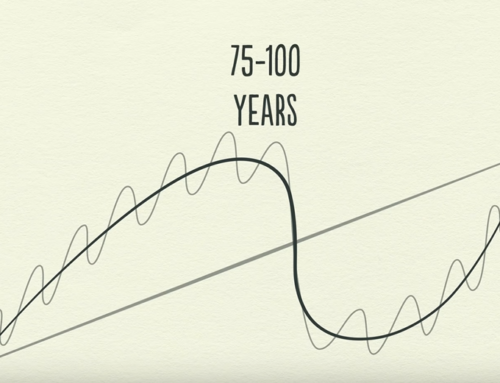

The discussion at one of our Plexus Performance Group meetings this spring was about the book, The Age Curve, by Kenneth W. Gronbach. The author describes the size of each of the five living generations and the impact each one has had, is having, or will have on the marketplace. Coincidentally, we also had discussions at two of the Plexus meetings about larger diamonds coming in for sale recently. The subject of the book and the discussion of what to do with the larger diamonds seemed to be unrelated, but it doesn’t appear to be two unrelated subjects at all.

Have you noticed an uptick in larger diamonds coming in for sale? The numbers of larger diamonds being brought in for sale are increasing. Jewelers are telling us that diamonds they sold 25 years ago are recently being brought in for sale and it dawned on me that the jewelers who have been in the same town for at least the past few decades are going to be the natural place for the customers to go first to sell them.

My father opened our first store in 1968, 44 years ago. A 40 year old customer who purchased a 2 carat diamond in 1968 is now 84 years old! The 40 year old who bought one in 1978 is now 74 years old, and the 40 year old who bought one in 1988 is 64 years old! You get the idea…. Consider all of the jewelry and gemstones that were purchased in the 60’s, 70’s and 80’s… The people who purchased all of that merchandise are now in their 60’s, 70’s and 80’s!

While some of these diamonds have been brought in over the past few years due to the economic challenges, there is a much bigger reason they are showing up now.

The leading edge of the Baby Boomers as well as those from the Greatest Generation (the WWII generation), are downsizing. The kids have moved out and they aren’t doing the same kind of entertaining, trips and playing dress up like they used to… so the jewelry sits in jewelry boxes or bank vaults. Others are at the point where they are thinking about which of their assets to leave to which of their heirs. It may be less stressful for them to just liquidate the jewelry and put the cash into their estate, rather than having the kids argue over grandma’s diamond.

Whatever the reason, billions (and I mean manybillions) of dollars of inventory that is just sitting is now coming out of their hiding places and being absorbed back into the marketplace. Obviously, the amount of gold that has come in to be scrapped has supplied an enormous amount of cash flow (not to mention melee!) to the industry. And while we’ve been talking about that for some time, it’s a very good idea to have a strategy in place to deal with the larger diamonds that will likely be walking in your door. Whether to outright purchase them, offer to broker them to a dealer or keep them in-house on consignment, getting a good handle on each of these scenarios will come in handy in the coming months and years. Did I mention, we’re talking billions?

Understand the market: Do you have a plan to liquidate the larger diamonds? Unless you have the cash on hand to buy them, you should know which of your diamond suppliers are going to pay you a fair price, or be able to broker them into the trade for you. Given the scarcity of larger, better goods, it would also behoove you to be able to access the lists of diamonds that are available online so you can check up on their going prices. While there may be nothing new in this article, it appears that many jewelers don’t have a specific strategy to deal with the larger goods that are coming in and this is a great time to develop those strategies.

Speaking of strategy, I also recommend you pick up a copy of The Age Curve and think about the coming generation, Gen Y, which is far larger than the Boomers, at 100 million strong. They are going to have an enormous influence on our businesses (and on everything else too), especially for entry level purchases. Let’s make them welcome and have cool inventory for them at affordable prices. They’re going to be around for a very long time! Get ready to ride the next wave.