JBT Credit Rating Declines

by Abe Sherman – CEO, BIG – Buyers Intelligence Group

August 23, 2023

There is a noticeable uptick in declining JBT credit ratings that I believe is foreshadowing cash flow issues that will become more apparent by the end of this year.

For those not familiar with how JBT ratings work, it’s pretty straight forward. A 1 rating means this company pays their bills on time. A 2 means the company can be a bit behind with a few suppliers and this won’t usually impact credit limits. However, things start to get snarky when the JBT rating drops to a 3 – which means suppliers will be reluctant to extend credit due to many reported late payments. Simply put, those with a JBT rating of 4 are sold on a COD basis, if at all.

As a JBT member, we receive weekly updates on changes to credit scores, business closing and openings and other newsworthy items. Once a month a more comprehensive email is sent that lists upwards of 1,000 companies. For the past two years, nearly everyone had excellent JBT ratings; most companies were rated a 1 since cash flow in our industry was superb and we were enjoying the post Covid business tsunami. Clearly that has come to an abrupt halt.

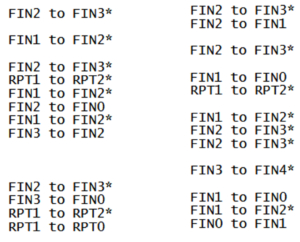

I copied a few sections from throughout the report to demonstrate the rating declines. These numbers represent (mostly) retail stores and list one store right after another. As you can see, not ALL credit ratings dropped, but what caught my attention this week was the sheer number of credit rating declines.

Payment Reporting is Automated

Many suppliers submit payment history to JBT automatically via the JBT interchange. Your own company’s payment history reflects the terms as they are entered into the supplier’s AR system. For the purposes of this article, I’m going to assume that information is entered as agreed between supplier and retailer. Therefore, hundreds of stores are now showing up as late, somewhat past due or seriously past due, which is reflected in these rating declines.

Why is this happening? We are experiencing a ‘back-to-normal’ slow-down after the two post-Covid years of sales growth, inventory declines and a huge increase in cash (balance sheets had never been healthier for our industry). But as the boom cycle returned to pre-pandemic norms, as consumers ramped up travel and experiential spending, redid their homes, bought new cars and got married in record numbers, our industry went right along with the spending, especially on inventory. What had been extremely healthy cash balances along with lean inventories has been reversing this year. Inventories are up and cash is down. It’s really that simple. When your Cost of Goods Sold goes up faster than On-hand Inventory, cash flow improves. That’s assuming one doesn’t spend too much on marketing, payroll or a new boat. When inventory rises faster than your COGS, either cash balances decline, payables increase or both. This is what’s happening now.

Note to Suppliers

We have been wondering how these credit rating declines are going to impact vendor’s desire to sell-in more product, especially memo goods. Monitoring JBT ratings, which hasn’t been much of a concern over the past couple of years, has become important once again. Helping your retailers with sell-through analysis and being more strategic about what inventory to add, remove or reorder should be a part of your sales team’s repertoire.

Cash is King – Again

For the past decade, interest rates were historically low and therefore, borrowing costs were negligible. On the other side of declining credit ratings is suppliers’ increasing aging Accounts Receivables which raises their cost of doing business. For those of you who maintain strong cash balances, I would encourage you to ask for any early-pay incentives that your supplier may offer. This helps suppliers with their cash flow, and it is the quickest way to increase your gross profit. Taking early-pay discounts should be a best-practice for your company – it also forces you to manage cash and inventory levels more closely.

This is Reversable

The decline in cash flow is reversable, but it takes discipline. Inventory levels are up to you. Your gross profit is up to you. Your expenses are up to you. Managing non-performing inventory is up to you. No one wants to be behind on their bills (okay, some people don’t care, but most of us like to pay our bills on time) and you have time yet this year to fix it between now and the end of the year. Don’t hesitate to reach out if you’d like some help.