Prepared Not Scared

by Abe Sherman – CEO, BIG – Buyers Intelligence Group

November 21, 2023

“If you’re not worried, you need to worry. And if you’re worried, you don’t need to worry”, is one of my favorite quotes from Ray Dalio, founder of Bridgewater Associates, the largest hedge fund in the world. Hear it from Ray himself:

We are having an increasing number of conversations from both retailers and suppliers who are worried. They are worrying about a recession, inflation, energy prices, wars, diamond prices, what to do about lab-grown diamonds now, facing an election year, our borders, cyber-attacks, finding and keeping good employees. They are worrying about some of these things or all of these things.

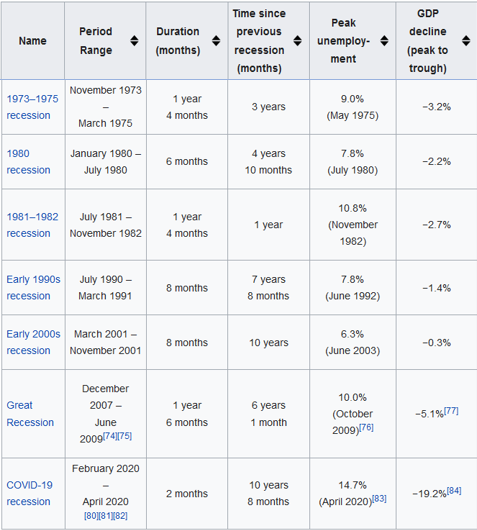

One of the retailers who called me several weeks ago started checking some of these (worry) boxes and when he was done, I asked, “What are you worried about? You have just had the three best years in the history of your company, have lots of dough in the bank and little debt. Your inventory is under control, your team is well trained and you’re healthy. So, what are you worried about? I began to rattle off the various economic cycles we’ve experienced over and over again which occur roughly every 8-10 years depending on what’s going on in the world. Those of us who have been around a while have experienced many if not all of these times.

Let’s accept that stuff happens that are beyond our control. We cannot stop economic business cycles; inflation, recessions, wars, energy prices, or any of the other things that impact your lives or businesses. So, stop worrying about them, but rather, prepare for them.

Good times don’t last

Unfortunately, the pattern we are seeing, the expectation that the post-Covid boom was going to last for the foreseeable future, created the sense of optimism that mirrored consumer spending – so once again, we grew our inventory. Now, however, as sales have begun to settle down, the bills have come due and balance sheets in many cases are looking worse off than they were a year or two ago. Meaning, cash is down and inventory, especially aged inventory, is up. Retailers will be able to live off of this inventory for the next year or two. But there is a bigger problem on the suppliers’ side of the industry: Retailers are being cautious.

Bad times don’t last

Fortunately, bad times don’t last either, although during challenging times, we don’t think things will ever get better. But they always have in the past and there is no expectation that this time will be any different. At this moment, the economy is still doing well, and I would encourage each of you to take the rest of this year diving into the areas of your businesses that need to be trimmed, especially non-performing inventory levels, which is a sponge soaking up your cash.

Understand the Cycles

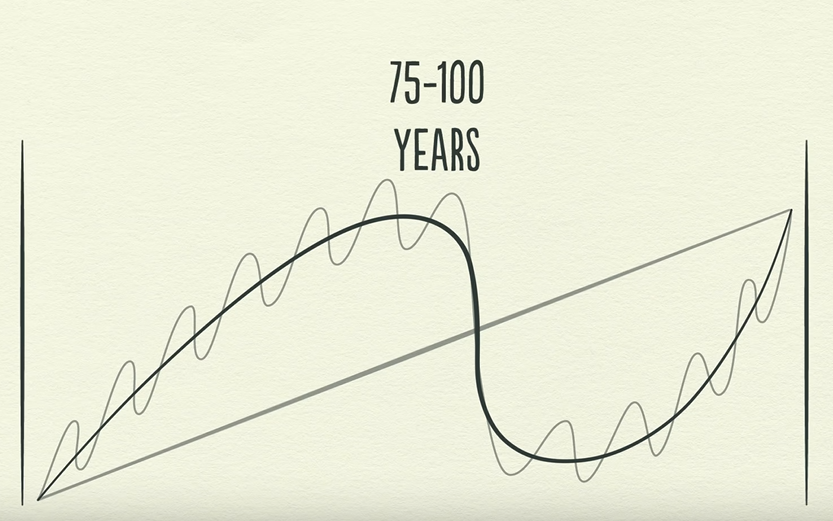

How The Economic Machine Works by Ray Dalio

That said, again according to Mr. Dalio, we are nearing the end of the long-term business cycle, which occurs once every 75-100 years or so. The future is likely not going to look like the past, but it never has. As business leaders, you have two jobs in my opinion. First, worry. Second, be prepared for the cycles.

What Prepared looks like

Being prepared is first about understanding your financials at a deep level. So many business owners can read an income statement, but really don’t have a grasp on how to interpret year-over-year differences. They look at their Balance Sheets and see that they have plenty of ‘assets’. The fact that much (often more than half) of those assets are tied up in inventory, in too many cases, a growing and aging inventory, is beyond typical Balance Sheet analysis. We separate current inventory from aged inventory when doing our financial analysis for retailers and we encourage our clients to review financial statements monthly.

Being prepared is about having at least three months of total expenses in savings. I prefer six months, but we see so little cash in some businesses that it makes me nervous. Having too little cash on hand means you won’t be able to handle a down-turn easily. The money is usually there, it’s just sitting in inventory. So…

Being prepared is about having a plan to lower your non-performing inventory. Sell it down by re-merchandising. Check out the link below for a short video I did years ago on how to re-merchandise your aged inventory.

Being prepared is about digging into your expenses. You should be analyzing every line item monthly, not just for dollars spent, but also percentages of total sales. Looking at the past few years for what’s happened with your expenses will show you where the money has gone. If needed, plan to cut expenses in order to build cash.

Will there be a slowdown? Yes. When will there be a slowdown? I have no idea. But I’m prepared for it.

Let me know if you want to chat.