It may be effecting the real estate market in your own area, or not. Housing may or may not be stacking up like the goods on the shelves at Costco, but it’s certainly been consuming the airwaves over the past weeks and it’s starting to show up in stores around the country. The sub-prime real estate debacle is having its effect on consumer behavior. Now I haven’t done a scientific study on the subject; no official surveys, but over the past few days, I’ve been talking with jewelers and they have all told me the same thing… Traffic is ok, but sales are off. In some markets, way off.

This is a marketplace that is feeling off. Whether or not the customer walking in has job security or not, there are likely dozens of homes for sale between their house and your store. Equity is dropping and all of the talking heads on TV are, of course, talking. And you should be aware that very little of that talking is upbeat and positive—at least in the short run.

In the short run, lots of people are nervous. Add it all up: the war, volatile stock market, volatile metals prices, oil prices, gas prices, shrinking price of the green back, the war, presidential politics, the war. People are nervous. Banks are nervous. Jewelers are nervous—and that is just about the time when my phone starts to ring or I start getting emails asking… “So, how are people doing out there?” OK! Fine! People are nervous, but what do we do about it?

First off, don’t panic, that’s my job. You should be working on a couple of things right now. I believe this is going to be a season not of the haves and have-not’s, but the season of the secure and insecure. Secure retailers are going to buy inventory, they are going to spend money on advertising and they are going to understand the reality of their marketplace—that although price points may be lower, much lower in many places, people will come to them to shop. And secure customers are going to shop. Those will be the people who bought their homes more that five years ago, have plenty of equity and didn’t take their equity out to go on that trip around the world two years ago. They’re fine, although my gut tells me that for the most part, they will be conservative shoppers.

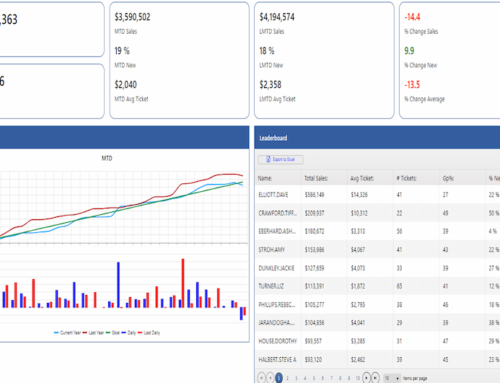

Simply put… we need to make sure that we are very specific in what we spend our dollars on. It’s time to hunker down over the next few weeks and look at your inventory levels by department and by vendor. If you’re not getting at least a one-time turn of that inventory, you cannot buy any more unless you stock balance it with the vendor to get your inventory in line by category and price point! I have been doing analysis after analysis and the same tune is being sung across the country. Cash flow stinks and branded lines are pushing harder than ever. I KNOW it’s getting very hard out there because stores we deal with who don’t carry a lot of brands, and are well rated, are being courted by the branded lines even though they are in stores a mile a way! Why?… you might ask, because the store a mile a way isn’t paying them! So they are looking for a new home for their ‘brand’. For the most part, unless this is THE line, I’d suggest you wait it out. This is not the time to experiment unless you have extraordinary cash flow.

This is a time of opportunities. Stores are closing, lines are looking for new ‘partners’ and if you play it cool, really cool (but not arrogant), the deals will be structured in your favor. Stock balancing, terms, buy backs if it doesn’t work, marketing support, trunk shows—you name it. But, you’d have to be able to step up to the plate. I’m going to write more about this, especially the prices and ‘stuff’ but I wanted to get this out there because jewelers are being offered ‘deals’. Let’s be careful what we buy this season.