by Abe Sherman – CEO, BIG – Buyers Intelligence Group

January 12, 2022

I don’t even have to ask how you did. If you are in the jewelry business, you did well in 2021. There hasn’t been a year like this in decades, if in fact we ever had a year like this – with across the board increases, a significant reversal in traffic counts, increases (in many cases) in average ticket and, at the same time, an increase in gross profit %. Let’s get into the data:

2021 Results

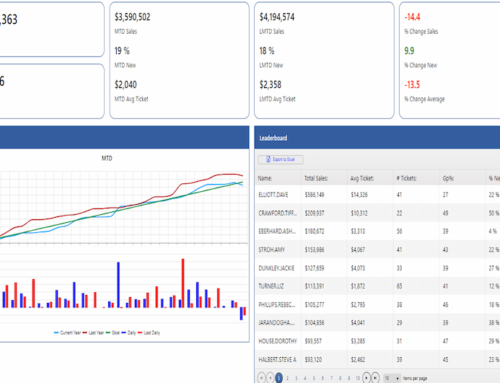

Total retail sales in our database for 2021 was $4,740,000,000*. This compared with 2020’s sales of $3,244,000,000 or a 46% increase on the year!

At the same time, jewelers were able to achieve an additional 1.1% gross profit, which given a 46% increase in sales, is really impressive and also meant that people held firm on their prices.

The 46% increase is an overall result of total sales compared with 2020. As very few new stores were opened in 2021, this also is fairly representative of Same Store results. That said, 46% is merely an average of everyone, and by now, you should know how we feel about averages (meh), but still a useful starting point for further analysis. While there was a very wide range of results from single digits to increases of up to 80% over the previous year, it was true that a majority of retailers (over 60%) increased sales between 129% to 179% of last year – a stunning result.

December 2021

Interestingly, December did not demonstrate the same level of increases as the full year. I only ran December comps for our Plexus groups since we have great insights into specific reasons why people had some results that stood out. For example, a number of our Plexus members recently moved to new (far better) locations or expanded their showrooms – in every case resulting in significant gains.

Interestingly, there was a noticeable decline in how December contributed to the year overall. The trend for December showed declines as a percentage of the year – meaning, strong sales were prevalent throughout the year and even though December was very good, in many cases the month barely reached 20% of the total year’s sales, if that. In my opinion, this is a very healthy result but also a warning regarding how we should be thinking about budgeting and planning for the 4th quarter.

Traffic

As every retailer is still feeling the impact on their feet and legs, everyone is quite aware of how many more people came through their doors this year. The multi-year decline in foot traffic reversed itself with a vengeance, catching quite a few off guard, understaffed and exhausted. This is going to be a topic for future discussions, but this is the year to be reaching out to every one of these customers, especially the new ones! Much of the increases in sales was due to the increase in number of items sold, whether the average ticket increased or not. In fact, while many stores showed increases in average ticket sales for the year, December resulted in many average ticket decreases for the month. This was due to the impact of many, many more transactions occurring at more modest price points.

However, without the context of knowing the details of each door, much like the total averages of the 46% sales increase, assumptions will have to be made. For example, those who had exceptionally high sales (up to $1 Million) to a single customer last year would have shown significant increases in average ticket but knowing this helps to put those results into better context. Of course, if those sales occurred in any other month than December, that impacts the difference in the averages when comparing that month to the rest of the year.

2022

Naturally, the conversations this month have all included some version of “what will 2022 look like?” I’ll write more on this in the coming weeks, but I would not expect this year to build upon last year’s increases. It’s great to have goals, but for now, you should all be very thankful for your results and congratulations to each of you for getting through an otherwise challenging year with such remarkable numbers.

To review your own multi-year results, please contact your Balance to Buy consultant to set up an appointment. Of course, feel free to reach out to me at any time.

*Our database consists of roughly 900 doors throughout the US, including a number in Canada and elsewhere in the world. Only items that were given SKU numbers were included, including bulk items.