The Banking Crisis

by Abe Sherman – CEO, BIG – Buyers Intelligence Group

March 21, 2023

We cannot escape the news (and noise) about recent banking issues along with the questions we’re getting from clients about how they should handle their bank balances. I asked my long-time accountant and dear friend, Jim Colitsas, CPA, to provide an outline to share with our clients and industry friends about what these specific situations are about. Jim is not only a CPA and RIA but has degrees in Economics, History and Political Science. When we talk about business and how things are looking in the economy, the conversations are far broader than just income statements and balance sheets. Below are his thoughts. The bolding and underlines are mine.

Abe

Banking Crisis 2023

I. What is happening

a. Media – on both sides pushing agenda not facts

i. One side failing banks are not focused on the business of business

ii. The other side overly aggressive – unregulated finance bros

iii. Truth

1. Rising interest rates first time in 40 years – few if any of the employees have worked through this

2. Increase in cash deposits held by banks

3. Made mistakes – but not necessarily distracted, reckless or overly aggressive

b. SVB

i. Huge infusion of cash ($49 billion in 2018 to $189 billion in 2021)

1. Side note (scope of run) $42 billion left the bank on March 9th

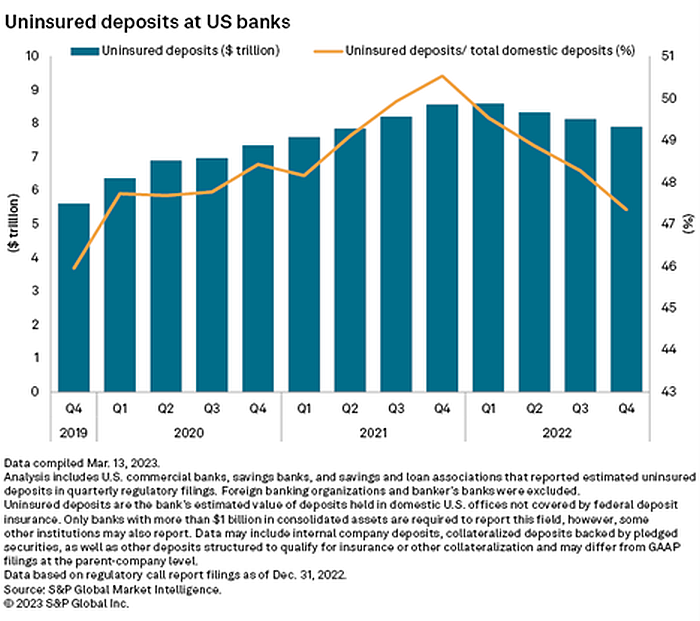

ii. Over 80% of deposits were uninsured – national average is less than 50%

iii. Did not have enough good loan opportunities so invested in Treasury bonds

1. Mistake was bond duration was too long, timing of purchase was unlucky/poor (early 2021) interest rates went up, bond prices went down – value of bank reserves went down

iv. Outside funding for startups slowed, startup bank balances began to fall, and had to sell $21 billion in held-to-maturity-bonds at a $1.8 billion loss

v. Leaders in the community, fearful of being the person without a chair when the music stopped, called on their companies to pull their cash from SVB which lead to the fastest bank-run I have seen in my lifetime

c. Signature (and Silver-gate sort of)

i. More aggressive/innovative strategies – with cryptocurrency exposure

ii. Have some real issues

iii. Nearly 90% of deposits uninsured

iv. Contagion – led to a good old fashion bank-run

d. Credit Suisse

i. Really poorly managed in recent years – including criminal investigation

ii. Saudi’s out, Swiss government in $54 Billion Franc loan

iii. Assets need to be distributed/split up– why buy?

e. Republic Bank

i. Statistically better than SVB and Signature

ii. Still 2/3 of assets uninsured

iii. Most assets are invested in loans, not securities, but tied up, bonds are actually Muni’s – so more aggressive then SVB

iv. Has not seen – “run” like the other banks

f. Of note all above banks cater to high net worth client base

II. Government and Large Investor response

a. “Insured” all deposit and gave immediate access to funds for all account holders

b. Lending program for other financial institutions impacted by SVB failure

c. Shopping for a buyer or multiple buyers

III. Action steps

a. Don’t panic

b. Know your exposure

i. $250k limit for each legal entity per bank

ii. Individual, businesses, etc.

iii. Create a cash management plan

iv. Know your bank – especially if it is a small or regional bank

1. What percentage of their deposits are uninsured

c. Have a secondary banking option – to make deposits and payments

Abe’s thoughts: regarding the SVB bank-run – When borrowing slowed, SVB bought billions of dollars of long-duration government bonds, which are perfectly safe if they are held to maturity. However, when some of their hedge fund and private equity folks pulled out $42 Billion in a single day, the bank was forced to sell $21 billion of their long-duration bonds. Because interest rates increased dramatically during the prior 12 months, those bonds (having been sold with their lower rates and long duration) were worth less, showing as a $1.8 Billion loss for the bank. SVB had plenty of assets, but instead of investing their huge excess cash reserves in short-term T-bills that were going up along with the Fed rate increases, they made the very poor choice of tying up the money at low interest rates.

A BIG Thank You to Jim Colitsas of Princeton Financial Group for his insights.