Compared to What?

by Abe Sherman – CEO, BIG – Buyers Intelligence Group

October 25, 2022

There has been so much talk about recession, causing what I feel is unfounded worry. This is not to say that you should be planning for sales increases, but that you understand how you might want to compare this year to 2020 & 2021, which were arguably the best performing two years in our industry’s history.

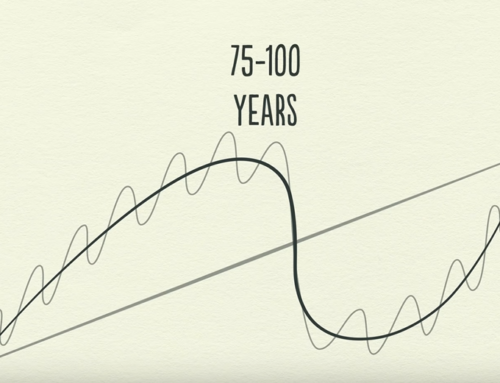

The normal ebbs and flows of what is roughly a 10-year business cycle was thrown completely off kilter due to the Pandemic which was followed by trillions of dollars pumped into the US economy. With travel cut to zero, significant global supply chain disruption and several hundred million people with no where to go, the jewelry industry benefited greatly from pent-up demand. We don’t need to get into all of the areas that consumer behavior impacted the jewelry industry, but benefited we did.

In 2022 however, the supply chain disruptions, along with the trillions in stimulus money, directly impacted the supply/demand balance, causing inflation and literally stupid prices being paid for, well, everything. Over the past several months the increase in interest rates required to try to tame our inflation should slow things down… but compared to what?

What we hope is a post-Pandemic return to ‘normal’ looks very different from this end of the telescope. Looking back just a couple of years when everyone was shut down for weeks or months, the fear was real – we had no idea how long the lock-down was going to last and what impact Covid was going to have. But immediately upon reopening, business boomed. The growth was astounding and the result on sales, cash flow and debt was unprecedented.

So, today we are starting to see some sales declines – compared with last year, and that’s what I’d like to flesh out for you. Let’s talk about the reality of a reversion to the mean – or taking a more realistic look at setting your expectations for the next year or two.

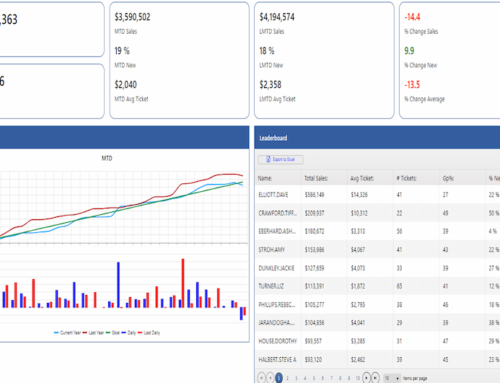

A jeweler called me a couple of months ago, concerned that two months this year fell short of 2021’s sales numbers. I wasn’t surprised at all. What surprised me has been how well sales have held up for most of 2022 given the numbers we have been up against. So, I ran the following analysis.

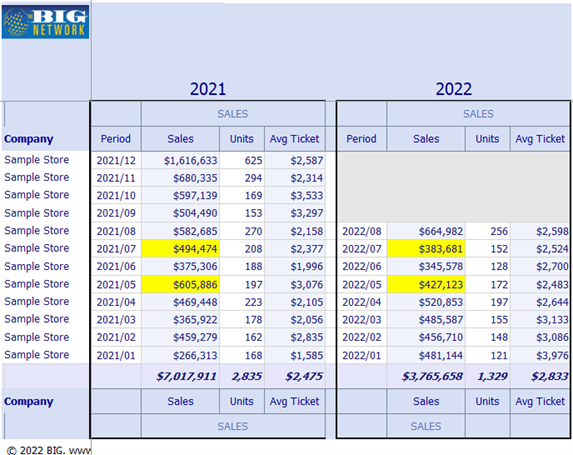

I began by running monthly sales for all of 2021 and thru August of 2022 (I did this in September), highlighting the two months (May & July) with declines.

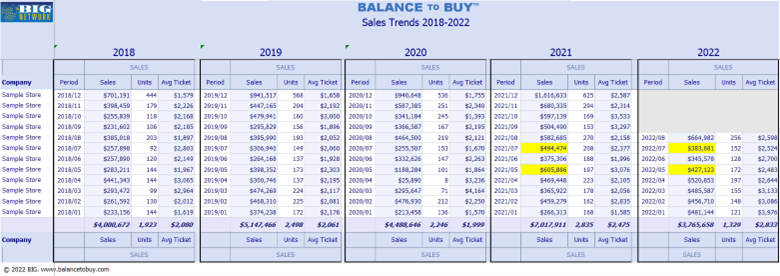

Then I ran this same monthly analysis for 5 years so we could see the progression of sales over time. In this case 2019 had about a 28% increase over 2018 with a similar average unit price of approximately $2070. But in 2020, due to the shut-down, several months declined substantially (March – May). Then you can clearly see how 2021 took off in units, average unit price and the resulting sales. This store grew from $4 million in sales in 2018 to $7 million in 2021! The 2021 sales result was typical throughout the country and was a direct result of the aforementioned reasons.

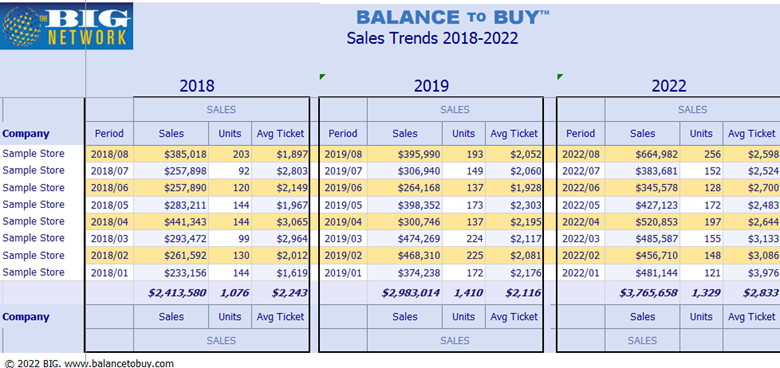

Then, because 2020 & 2021 were outliers and cannot be relied upon for normal trending, I removed those two years so we could see how we were doing without the noise in the data. I compared just Jan-Aug for the three years, removing the outlier years of 2020 & 2021. As you can see, this store up more than $800,000 over 2019 numbers, our last “normal” year.

The key take-aways here is to consider what you are comparing your numbers against and the reasons why sales increase or decrease. Also, please set your expectations for how you are planning for the next two years. Do yourselves a favor and remove 2020 & 2021 from your numbers and use 2019 to create your goals and inventory budgets. While our industry benefited from unexpected sales, a boon to cash flow and virtual elimination of debt, basing your sales and inventory goals on 2021’s number is already causing issues.

Inventories are moving back up; cash balances are declining, and debt is starting to increase. We are very rapidly going back to pre-Covid behaviors at the same time that we should be expecting a decline in traffic and sales. Be conservative, stay lean, build cash and reorder more frequently. Business is doing very well – just be aware of what you are comparing your numbers to. As always, please don’t hesitate to reach out with questions.

Two more shopping months to Christmas!